Not all types of shipments are created equal. Shipping a television will

require different paperwork, duties, and taxes than shipping an accounting

statement, for example.

Here is a list of the most common types of shipments:

You can also skip ahead to the table containing the list of

Commonly Required Documents.

Shipping documents to the United States (US) is very simple and only

requires a shipping label (no commercial invoice required). Document

shipments enter the country duty and tax free provided they qualify

(see Document Type list).

It's important to note that US Customs can perform an examination

should they wish which can add a day delay to the transit time

however, this does not happen very often.

| Document Type | Restriction |

|---|

| Business cards | Blueprints |

| Cheques | Advertising brochures/pamphlets |

| Exam papers | Drawings, technical/architect/eng |

| Greetings cards and invitations | Publication not for public resale. |

| Passports | Documents, general business |

| Stationery | Annual reports |

| Visa applications | Charts/graphs |

For a complete list of restrictions see here

Gifts that are valued at $100 USD or less (approximately $130 Canadian

Dollars) can be shipped to the United States (US) without having to

pay duties and taxes provided the following conditions

are met:

- The words "Gift Shipment" or "Unsolicited Gift" are included on the

commercial invoice (see sample)

- A detailed description and name of each item is provided on the

commercial invoice

- Any alcohol, tobacco, and perfume products have a retail value of

less than $5

- The value of all gifts is $100 USD or less

If the value of the gift exceeds $100 USD or contains dutiable items

such as alcohol or tobacco, duties and taxes would be charged on the

shipment.

NOTE:

If you are shipping food, chocolate, or candies, you'll also need to review

the

Shipping Food

section of this guide.

Shipments from Individual-to-Individual

Only the above 4 conditions must be met to have your shipment exempt from duties and taxes.

Sending multiple gifts to the same location? See Multiple gifts in one shipment to the US.

NOTE:You cannot ship gifts to yourself.

Shipments from Business-to-Business

The receiver of the package will have to pay duties and taxes on gifts

sent between businesses.

Shipments from Business-to-Individual

Gifts sent by a business to an individual may qualify for duty and tax

free entry providing certain conditions are

met:

- The above 4 conditions are met

- The gift cannot be divided amongst multiple recipients

- There must be no payment or promise of payment

- It cannot be a gift given as a bonus to an employee

Sample Commercial Invoice for Gifts

| Ship To | Invoice |

|---|

Smith Family in New York

James Smith

1 Abbott Street

New York City, NY, 10011

Phone: 613-555-1234 | Carrier tracking number: 736534736

General Description:

Personal Shipment / Gift Shipment

Invoice number: 123456MGEP4916926

Customs Broker: UPS

Date: 28 May 2023 |

| QTY | Description of Goods | C/O | SubTotal |

|---|

| 1 Each | Gift Shipment: LEGO Star Wars Rebel UWing Fighter, 659 piece set

| CA | $79.99 |

Terms of Sale: None

Total number of packages: 1

Reason for export: Gifts

Contact Name: James Smith

| Total Invoice Amount: $79.99

Total Weight: 10.0 lbs

|

| Declaration Statement: I hereby certify that information provided

is true and complete to the best of my knowledge |

Sending Multiple Gifts to the United States (U.S.)

Multiple gifts can enter the United States (US) in a single shipment

tax and duty-free when the following is written on the commercial

invoice:

- Words "Unsolicited Gift: Consolidated Gift Package" appear in

General Description of Goods as well as the Detailed description of

goods (see sample)

- Recipients' names; and

- Nature and value of the gifts inside. For example, tennis shoes,

$50; shirt, $45; toy car, $15.

NOTE:

The gifts will need to be individually wrapped and tagged with the name

of a different recipient on each.

Sample Commercial Invoice for Gifts

| Ship To | Invoice |

|---|

Smith Family in Los Angeles

James Smith

1 Abbott Street

Los Angeles, CA, 90021

Phone: 613-555-1234 | Carrier tracking number: 736534736

General Description:

Unsolicited Gift: Consolidated Gift Package

Invoice number: 123456MGEP4916926

Customs Broker: UPS

Date: 28 May 2023 |

| QTY | Description of Goods | C/O | SubTotal |

|---|

| 1 Each | Unsolicited Gift - Roger: LEGO Star Wars Rebel UWing Fighter, 659 piece set

| CA | $39.99 |

| 1 Each | Unsolicited Gift - Erica: Handwoven French Canadian Catalogne Blanket

| CA | $49.99 |

Terms of Sale: None

Total number of packages: 1

Reason for export: Gifts

Contact Name: James Smith

| Total Invoice Amount: $89.98

Total Weight: 10.0 lbs

|

| Declaration Statement: I hereby certify that information provided

is true and complete to the best of my knowledge |

Sources:

https://www.cbp.gov/travel/international-visitors/kbyg/gifts

https://help.cbp.gov/app/answers/detail/a_id/717/kw/shipping%20gifts

https://help.cbp.gov/app/answers/detail/a_id/354/kw/shipping%20gifts

https://www.ups.com/ga/CountryRegs?loc=en_US

Personal effects can be shipped to the United States fairly easy. It

refers to moving your personal belongings cross border.

Just like all non-document packages, your shipment will need to be

properly declared and will go through the US Customs clearance

process. Shipping personal effects does require additional paperwork (CBP Form 3299) and without it, your shipment will be held at customs until one is

included.

In order to qualify for duty-free exemption, the following conditions

must be met:

- Items must be for your use only;

OR

- Items must have been used in your household for a minimum of 1 year.

NOTE:

Customs may ask for proof that you have owned the items for at least 1

year. Receipts, invoices and warranties can be used as proof.

Documents Required

- A Commercial Invoice clearly declaring that they are Personal

effects

- Form

CBP3299

for personal effects (in order to avoid paying duties and taxes). Restrictions

apply depending on your US citizenship status

- A copy of your passport photo page

More information on forms needed for shipping personal effects can be

found

here.

NOTE: Custom border patrol may require

documents proving your residency status in the

US, it is at their discretion. They may also request a packaging list of

the goods shipped.

Sources:

https://help.cbp.gov/app/answers/detail/a_id/107/~/moving-to-u.s.---household-and-personal-effects%2C-packing-%2F-inventory-list

https://test.secureship.ca/learning-center/shipping-206-common-international-shipping-documents/#personal-effects

https://help.cbp.gov/app/answers/detail/a_id/351/related/1

Sample Commercial Invoice for Personal Effects

| Ship To | Invoice |

|---|

Smith Family in Chicago

James Smith

1 Abbott Street

Chicago, IL, 60624

Phone: 613-555-1234 | Carrier tracking number: 736534736

General Description:

Personal effects being delivered to my new address.

Invoice number: 123456MGEP4916926

Customs Broker: UPS

Date: 28 May 2023 |

| QTY | Description of Goods | C/O | SubTotal |

|---|

| 5 Pairs | Personal Effects: 5 pairs of various types of shoes

| IN | $40.00 |

| 1 Each | Personal Effects: Arc'terix Winter Jacket

| CA | $478.00 |

Terms of Sale: None

Total number of packages: 1

Reason for export: Personal Effects

Contact Name: James Smith

| Total Invoice Amount: $678.00

Total Weight: 10.0 lbs

|

| Declaration Statement: I hereby certify that information provided

is true and complete to the best of my knowledge |

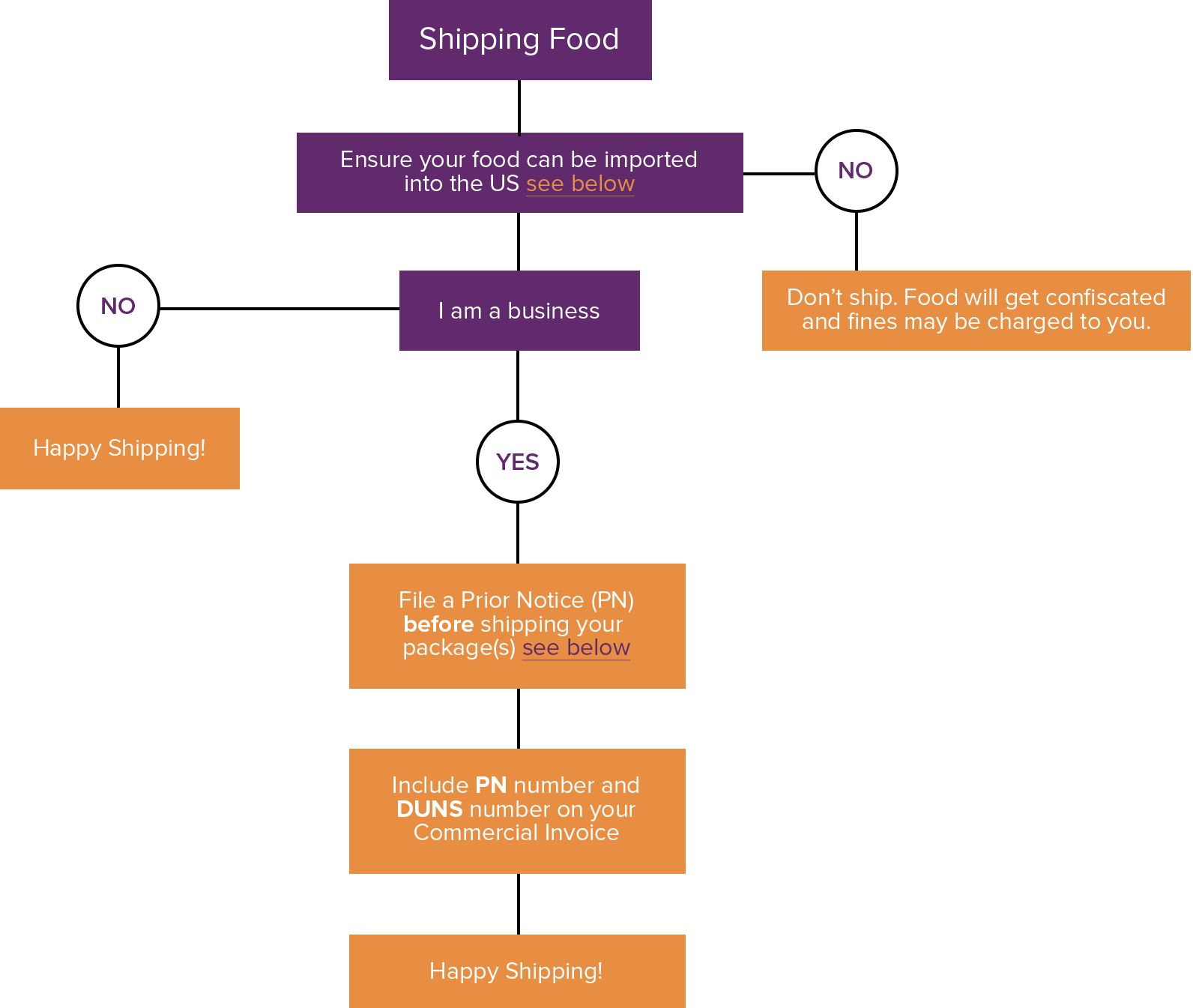

Shipping food into the United States (US) can be a straightforward

process. Individual to individual shipments do not require Prior

Notice.

If you are a business, you must Submit a Prior Notice with the Food

and Drug Administration (FDA) before shipping if you are a business.

Generally accepted foods:

- Unopened or commercially packaged food

- Bakery items

- Most Cheeses

- Condiments

- Chocolate

- Candies

General Items to Avoid or that Are NOT permitted:

- Fruits and Vegetables

- Rice (tend to harbor insects)

- Meat (regulation varies visit

here

and

here

for more information).

Generally, fresh, dried, or canned meats are not permitted into the US

(including products prepared with meat)

Complete list of prohibited and restricted food entering the US can

be found here.

Why is a Prior Notice Needed?

The prior notice is intended to help protect the United States (US)

from things that can hurt or destroy their local economy (such as

insects, viruses, or bacteria) by alerting them that a consumable

product will be entering the United States (US). Any items subject to

FDA normally incur at least 1-day delay in customs.

How a business can ship Food to the United States?

In order for a business to ship food or anything that requires Prior

Notice to the United States, they must:

- Check with your carrier before shipping as not all will accept food

shipments (or they will but it is considered ship-at-your-own risk)

- Ensure you are not shipping a prohibited food item

- Complete Prior Notice (PN) through the

FDA Web Portal

- The PN Number is included on the shipping label

- The PN Number and Receiver's DUNS number are included on the commercial invoice

NOTES: - When an individual ships homemade food as a personal

gift, or when an individual ships food or a food gift basket to another

individual a Prior Notice is NOT required.

- DUNS Number - This is a unique nine-digit identification number, for

each physical location of a business registered with the US federal

government. You can simply ask the receiver to provide you with this

number

How to Submit a Prior Notice?

Submitting a Prior Notice is quite easy. You simply have to complete

an electronic form via the

FDA Web Portal site and normally takes 5 minutes.

NOTE: Any business shipping food, even on

behalf of a customer, would need to submit Prior Notice.

Sources:

https://help.cbp.gov/app/answers/detail/a_id/944/kw/meat https://www.fda.gov/Food/GuidanceRegulation/ImportsExports/Importing/ucm082154.htm#gifts https://help.cbp.gov/app/answers/detail/a_id/1272/~/food---general-food

Sample Commercial Invoice for Food, Chocolate, Candies

| Ship To | Invoice |

|---|

Smith Family in Alaska

James Smith

1 Abbott Street

Alaska, AK, 99833

Phone: 613-555-1234 | Carrier tracking number: 736534736

General Description:

Food Shipment - Assorted chocolate bars in their original manufacturer's packaging

Invoice number: 123456MGEP4916926

Customs Broker: UPS

Date: 28 May 2023 |

| QTY | Description of Goods | C/O | SubTotal |

|---|

| 1 Box | Nestle Chocolate Bars in original packaging expiring May 2021 (shelf life of 6 months or longer)

| CA | $20.00 |

Terms of Sale: None

Total number of packages: 1

Reason for export: Permanent / Sold

Contact Name: James Smith

| Total Invoice Amount: $20.00

Total Weight: 10.0 lbs

|

| Declaration Statement: I hereby certify that information provided

is true and complete to the best of my knowledge |

Commercial samples are goods imported to facilitate the placing of an

order and are used only for demonstration purposes only.

Commercial samples can be imported duties and tax free provided the

following conditions are met:

- The word "Sample - Not for Resale " is stated on the commercial

invoice under General Description and Detail Description of Goods

- Specify the

HS Code for the sample on the Commercial Invoice

- The sample are not resold under an exact duplicate or replica (i.e.

knock-offs)

- Samples that are marked, defaced, torn, perforated or otherwise

treated so that they are unsuitable for sale

- Does not contain food to be eaten or consumed. See Food Samples for more info

Additional notes

- The sample can be a different size or material than the good it is

representing

- The sample can be a miniature version or have a cutaway sample

revealing the construction of the product (i.e. cut in half showing

the inside of the item)

- Cloth samples and color cards that display the different colors of

merchandise are eligible

Food Samples

Although food samples (and other consumables) may be brought in as

"commercial samples" for display and solicitation of orders, they may

not be distributed as samples to be eaten or consumed.

If they are to be eaten (or otherwise consumed in a normal matter),

regular entry and duty payment (if any) are required

Businesses shipping food samples must also complete a Prior Notice. See Shipping Food to the US

Sources:

https://www.cbp.gov/sites/default/files/documents/icp066_3.pdf

Sample Commercial Invoice for Commercial Sample

| Ship To | Invoice |

|---|

Smith Family in California

James Smith

1 Abbott Street

California, CA, 90002

Phone: 613-555-1234 | Carrier tracking number: 736534736

General Description:

Commercial Sample - Not for Resale

Invoice number: 123456MGEP4916926

Customs Broker: UPS

Date: 28 May 2023 |

| QTY | Description of Goods | C/O | SubTotal |

|---|

| 1 Box | Commercial Sample - Advanced reading copy of Dan Brown's novel.

| CA | $20.00 |

Terms of Sale: None

Total number of packages: 1

Reason for export: Commercial Sample

Contact Name: James Smith

| Total Invoice Amount: $20.00

Total Weight: 10.0 lbs

|

| Declaration Statement: I hereby certify that information provided

is true and complete to the best of my knowledge |

Advertising material can be shipped free of duties and taxes includes promotional material that is given away, such as flyers and brochures. In order to qualify, the following

conditions must be met:

- the words "Promotional Material - Not for Resale" is stated on the

commercial invoice in the general description of goods

Sources:

https://www.cbp.gov/sites/default/files/documents/Importing%20into%20the%20U.S.pdf

(p47)

https://www.gov.uk/guidance/exporting-to-the-usa

Sample Commercial Invoice for Promotional Material

| Ship To | Invoice |

|---|

Smith Family in Texas

James Smith

1 Abbott Street

Texas, TX, 73301

Phone: 613-555-1234 | Carrier tracking number: 736534736

General Description:

Promotional Material - Not for Resale

Invoice number: 123456MGEP4916926

Customs Broker: UPS

Date: 28 May 2023 |

| QTY | Description of Goods | C/O | SubTotal |

|---|

| 1 Each | Promotional Material: Not for Resale. Product pamphlets to hand out at trade show.

| CA | $163.00 |

Terms of Sale: None

Total number of packages: 1

Reason for export: Promotional Material

Contact Name: James Smith

| Total Invoice Amount: $163.00

Total Weight: 10.0 lbs

|

| Declaration Statement: I hereby certify that information provided

is true and complete to the best of my knowledge |

Sending Product for Repair to the United States:

If you're sending your package for repair to the US, then the

following is required met in order to obtain duty-free

exemption:

- The words "REPAIR & RETURN" are stated on the commercial invoice

under General Description or Remarks

- Serial/Product number must be indicated under the Detailed

Description of Goods section on the commercial invoice

- Copy of Repair Contract included with all your export documentation

NOTE: Goods that are no longer under warranty

for repair would have to pay any duties and taxes when the shipment returns

to Canada.

Returning product after Repairs are Completed:

If your product has been repaired in Canada and is being returned back

to the United States, then the following conditions must be met in order to obtain duty-free exemption:

- The words "REPAIR & RETURN" are stated on the commercial invoice

under General Description or Remarks

- Value of the product INCLUDING the Cost of the

Repair must be indicated under the Detailed Description of Goods section

- Original shipping docs or tracking number from when the item was

first exported to the US

NOTE: If you don't have the original tracking

information or documentation then the recipient may be charged duties and

taxes on the shipment.

Sources:

https://www.cbp.gov/trade/nafta/guide-customs-procedures/effect-nafta/en-repairs-alterations

https://www.cbsa-asfc.gc.ca/publications/forms-formulaires/e15-eng.html

Sample Commercial Invoice for Warranty Repair

| Ship To | Invoice |

|---|

Smith Family in Georgia

James Smith

1 Abbott Street

Georgia, GA, 30002

Phone: 613-555-1234 | Carrier tracking number: 736534736

General Description:

Repair and Return - Watch being sent for repair

Invoice number: 123456MGEP4916926

Customs Broker: UPS

Date: 28 May 2023 |

| QTY | Description of Goods | C/O | SubTotal |

|---|

| 1 Each | Fossil Watch being sent for repair - Model E5, serial # 789456FG7E2 - Repair Cost $76.00

| US | $163.00 |

Terms of Sale: None

Total number of packages: 1

Reason for export: Warranty Repair

Contact Name: James Smith

| Total Invoice Amount: $163.00

Total Weight: 10.0 lbs

|

| Declaration Statement: I hereby certify that information provided

is true and complete to the best of my knowledge |

If goods are to be temporarily imported for use in the United States,

there are 3 options you can exercise in order to avoid having to pay

any import duties or taxes. Your goods must also qualify for temporary

imports. More information here.

Each option has its pros and cons. Regardless, each of the following

methods requires you to complete a Commercial Invoice (CI).

| Option # | Temporary Import Method | Risk of paying Duties and taxes |

|---|

| 1 | Commercial Invoice Only (no other documentation is provided) | High - if broker cannot clear goods temporarily |

| 2 | Commercial Invoice + Temporary Import under Bond (TIB) | Very Low |

| 3 | Commercial Invoice + ATA Carnet | Very Low |

1. Complete a Commercial Invoice (CI) only

This is the simplest and quickest option.

See example.

NOTE: You should be aware that

shipping using this method doesn't guarantee that your items will be

imported duty/tax free. Not all brokers will clear goods as

temporary imports (i.e. UPS, FedEx, DHL) nor is it a guarantee that

customs won't charge any duties and taxes.

2. Commercial Invoice (CI) + Temporary Importation under Bond (TIB)

When completing a TIB in addition to a Commercial Invoice (CI),

goods can enter the US free of duty and taxes provided:

- The goods are not being sold once they enter the US

- The importer agrees to export the goods or destroy the goods

within a certain time frame (one year) or to pay damages, which

are generally equal to twice the usual customs duty

TIB's have the capability of being extended up one year at a time,

to a maximum of three years. It is also highly recommended to

include a TIB for any shipments valued at $2500 USD or over.

It is also recommended that you

contact a local customs broker

to assist you with filing a TIB. Otherwise, you will need to submit the

bond and entry documents

described in the link.

3. Commercial Invoice (CI) + an ATA Carnet

Completing an ATA Carnet is great option for items that frequently

travel in and out of the country. It's also great because once you

have an ATA Carnet, it is accepted by 176 countries worldwide making

the application process a one-time thing.

In addition to declaring your commercial invoice as a temporary

import, you can get an ATA Carnet for the items that are of

temporary nature.

ATA Carnets are beyond the scope of the article however, you can

find more information here:

http://www.chamber.ca/carnet/

NOTE: It is highly recommended to get an

ATA Carnet for items that frequently travel in and out of the country

and especially so when it is valued over $2500 USD

In addition to 1 of the 3 items above, the following conditions must also be met:

- the goods leave the United States within one (1) year (potential

extension available if you include a TIB)

- the goods remain in the same condition as they were imported.

- the words "Temporary Import/Not for Resale" are stated on the

commercial invoice under General Description.

- the words "Temporary Import" and the anticipated return date are

stated on the commercial invoice under the Detail Description of

Goods (for all applicable items)

- customs broker selected can clear goods of temporary nature

- include the original tracking number and the import date if the

product is returning

NOTE: If the above conditions are not followed,

duties and taxes will be charged as though the goods have been imported

permanently.

Sources:

https://help.cbp.gov/app/answers/detail/a_id/139/~/carnets---advantages%2C-issuance%2C-obligations-and-expiration

https://help.cbp.gov/app/answers/detail/a_id/1212/kw/tib

Sample Commercial Invoice for Temporary Imports

| Ship To | Invoice |

|---|

Smith Family in Santa Fe

James Smith

1 Abbott Street

Santa Fe, NM, 87501

Phone: 613-555-1234 | Carrier tracking number: 736534736

General Description:

Temporary Imports - Trade show booth and display equipment returning Jan 2020

Invoice number: 123456MGEP4916926

Customs Broker: UPS

Date: 28 May 2023 |

| QTY | Description of Goods | C/O | SubTotal |

|---|

| 1 box | Temporary Imports - Trade show booth and display equipment

| CA | $1032.00 |

Terms of Sale: None

Total number of packages: 1

Reason for export: Temporary Imports

Contact Name: James Smith

| Total Invoice Amount: $1032.00

Total Weight: 10.0 lbs

|

| Declaration Statement: I hereby certify that information provided

is true and complete to the best of my knowledge |

All products sold that enter the United States (US) are subject to

duties unless they fall under the North American Free Trade Agreement

(NAFTA). The NAFTA agreement was designed to improve trade between

Canada, Mexico, and the United States and is designed to reduce or

eliminate Duties on a number of different items.

Thanks to NAFTA, the e-commerce industry continues to grow increasing

jobs, wages, investment and reducing costs of such items as oil hence

cheaper gas prices.

Sources:

https://help.cbp.gov/app/answers/detail/a_id/535/~/transporting-and-importing-commercial-goods-to-sale-in-the-u.s.

https://www.cbp.gov/trade/programs-administration/entry-summary/cbp-form-7501

http://www.naftanow.org/

Sample Commercial Invoice for Permanent/Sold Goods

| Ship To | Invoice |

|---|

Smith Family in Washington

James Smith

1 Abbott Street

Washington, WA, 98004

Phone: 613-555-1234 | Carrier tracking number: 736534736

General Description:

Permanent/Sold: Parts and accessories for Canon B78n camera

Invoice number: 123456MGEP4916926

Customs Broker: UPS

Date: 28 May 2023 |

| QTY | Description of Goods | C/O | SubTotal |

|---|

| 15 Each | Camera Lenses: Canon EF 50mm, Canon EF 85mm & wide-angle lenses.

| CA | $132.00 |

Terms of Sale: None

Total number of packages: 1

Reason for export: Permanent/Sold

Contact Name: James Smith

| Total Invoice Amount: $1980.00

Total Weight: 10.0 lbs

|

| Declaration Statement: I hereby certify that information provided

is true and complete to the best of my knowledge |

What does it cost to ship to the United States?

The costs to send a box to the US will vary based on the weight, size,

and destination city within the United States. Obtain

real-time quote for boxes to the US

by visiting our shipping calculator

here.

Does UPS ship to the United States?

Yes they do. You can send your packages with UPS through Secureship and

save up to 50% off the list UPS price.

Get an Instant Shipping Quote to USA here.

Does Canada Post ship to the United States?

Yes they do. Packages sent through Canada Post are typically handed off

to USPS once your shipment crosses the border. A lot of shipper's like

to send their packages through a Courier company instead because they

get detailed tracking information. You can send your packages through

Secureship and save up to 50% off the list price of major carriers.

Get an Instant Shipping Quote to the United States here.

What is the Cheapest Way to ship a Package from Canada to the United

States?

The cheapest way to ship to your packages to the United States (US) will

vary based on the size, weight as well as the from and to address.

Rather than trying to figure this out yourself, you're better off using

a shipping platform like Secureship. Secureship will help you find all the available shipping options.

Plus, you'll save up to 50% off the list price of the carrier because of

their group buying power.

Find the cheapest way to ship to the US here.

Can I ship food to the United States?

You can ship some food to the United States with relative ease but of

course, there are some items that you should avoid or that are not

permitted. Note: If you are a business shipping food, you will need to

complete a prior notice before shipping your items.

Generally accepted foods include: Unopened or commercially packaged food,

Chocolate, Candies, Most Cheeses, Bakery Items, Condiments.

General Items to Avoid or that Are NOT permitted include: Fruits, Vegetables,

Rice, Meat.

See our

Food, Chocolate, & Candies section for more information.

How long does it take to ship from Canada to the United States?

Delivery times will vary by carrier and service level chosen. Shipments

can be delivered by as early as 8 AM the next business day with the

carriers on the Secureship network. Slower and more economical services

can take up to 7 business days.

See delivery times for shipments from Canada to the US here.