Not all types of shipments are created equal. Shipping a television will

require different paperwork, duties, and taxes than shipping an accounting

statement, for example.

Here is a list of the most common types of shipments:

You can also skip ahead to the table containing the list of

Commonly Required Documents.

Most documents can be shipped tax and duty-free.

Some document types are restricted and should be indicated on the

commercial invoice. Duties and taxes are payable if you exceed the

restrictions.

| Document Type | Restriction |

|---|

| Business cards | Up to 15 |

| Cheques | Must be personalised |

| Exam papers | Up to 20 kg in weight |

| Greetings cards and invitations | Must be personalised. Blanks are not permitted. |

| Passports | The description on the package must clearly state "passports".

Customs inspections and delays are likely. |

| Stationery | Must be personalized |

| Visa applications | Must be completed. Blank applications are not permitted |

See here for a complete list of restrictions on documents.

Gifts that are valued at £39 or less (approximately $65 Canadian

Dollars) are exempt from duties and taxes, provided the following conditions

are met:

- The words "Gift Shipment" or "Unsolicited Gift" are included on the

commercial invoice (see sample)

- A detailed description of each item is provided

- The value of the gift is declared on the commercial invoice

- Shipment must be destined to a residential address (no business)

NOTE: Shipping a gift to an individual to

their work address will cause an issue - it'll be seen as a commercial

shipment and will not be exempt from duties and taxes.

Sample Commercial Invoice for Gifts

| Ship To | Invoice |

|---|

Smith Family in Bath

James Smith

1 Abbott Street

Bath, BA1 0AQ, England

Phone: 613-555-1234 | Carrier tracking number: 736534736

General Description:

Personal Shipment / Gift Shipment

Invoice number: 123456MGEP4916926

Customs Broker: UPS

Date: 28 May 2023 |

| QTY | Description of Goods | C/O | SubTotal |

|---|

| 1 Each | Gift Shipment: LEGO Star Wars Rebel UWing Fighter, 659 piece set

| CA | $79.99 |

Terms of Sale: None

Total number of packages: 1

Reason for export: Gifts

Contact Name: James Smith

| Total Invoice Amount: $79.99

Total Weight: 10.0 lbs

|

| Declaration Statement: I hereby certify that information provided

is true and complete to the best of my knowledge |

Sending Multiple Gifts to the United Kingdom (U.K.)

To avoid duties and taxes:

- Words "Unsolicited Gift: Consolidated Gift Package" appear in

General Description of Goods as well as the Detailed description of

goods (see sample)

- Individually wrap and tag each gift separately

- Ensure the names on each tag are different and clearly marked on the

commercial invoice

Sample Commercial Invoice for Gifts

| Ship To | Invoice |

|---|

Smith Family in Portsmouth

James Smith

1 Abbott Street

Portsmouth, PO1 1HE, England

Phone: 613-555-1234 | Carrier tracking number: 736534736

General Description:

Unsolicited Gift: Consolidated Gift Package

Invoice number: 123456MGEP4916926

Customs Broker: UPS

Date: 28 May 2023 |

| QTY | Description of Goods | C/O | SubTotal |

|---|

| 1 Each | Gift - Roger: LEGO Star Wars Rebel UWing Fighter, 659 piece set

| CA | $39.99 |

| 1 Each | Gift - Erica: Handwoven French Canadian Catalogne Blanket

| CA | $49.99 |

Terms of Sale: None

Total number of packages: 1

Reason for export: Gifts

Contact Name: James Smith

| Total Invoice Amount: $89.98

Total Weight: 10.0 lbs

|

| Declaration Statement: I hereby certify that information provided

is true and complete to the best of my knowledge |

Most goods can be shipped free from tax and duty if you have owned the items for longer than six months but you may be

asked to prove possession.

There are a few documents that can be used to prove this but that's

beyond the scope of this article. Examples include: receipts,

warranties, insurance documents etc.

Moving Temporarily

Students:

If you are a student travelling to the UK to study for at least twelve

months you can ship your personal effects to the UK free of duties and

taxes.

Document Checklist:

- Commercial invoice must clearly indicate "Personal Effects" and

include the Transfer of Residence (ToR) code written under General Description or Remarks section

- Proof of Enrolment must be included with your shipment

Non-Students:

If you are not a student, and you are moving your residence to the UK

for at least twelve months, you will need to apply for Transfer of Residence relief.

If you are moving your residence to the UK for less than 12 month, you

will need to apply for Temporary Admission of Goods.

Document Checklist:

- Commercial invoice must clearly indicate "Personal Effects" and

include the ToR code written under General Description or Remarks

section

- Temporary Admission of Goods form must be include with your shipment

if you are moving for less than 12 months, including the return

date. This information must be written under General Description or

Remarks section

Moving Permanently

If you are moving to the UK for 12 months or longer you will need to

complete a Transfer of Residence (ToR)

form before your move to claim exemption from duties and taxes.

NOTE: It is possible to apply for ToR relief

within twelve months of your arrival in the UK. However, you will need

to pay import duties and taxes on the items upon entry. If your ToR is

successful, you may be able to claim the import duties and taxes back.

Document Checklist:

- Clearly indicate "Personal Effects" and include the ToR code in the

"General Description" or "Remarks" section on the commercial invoice

- Include with your shipment your Transfer of Residence form

Sources:

https://www.gov.uk/government/publications/import-and-export-apply-for-temporary-admission-sp5

https://public-online.hmrc.gov.uk/lc/content/xfaforms/profiles/forms.html?contentRoot=repository:///Applications/Customs_B/1.0/TOR1&template=TOR1.xdp

Sample Commercial Invoice for Personal Effects

| Ship To | Invoice |

|---|

London Community Centre

James Smith

1 Abbott Street

London, E17 AE, England

Phone: 613-555-1234 | Carrier tracking number: 736534736

General Description:

Personal effects being delivered to my new address. TOR #: NNNNNNN

Invoice number: 123456MGEP4916926

Customs Broker: UPS

Date: 28 May 2023 |

| QTY | Description of Goods | C/O | SubTotal |

|---|

| 5 Pairs | Personal Effects: 5 pairs of various types of shoes

| IN | $40.00 |

| 1 Each | Personal Effects: Arc'terix Winter Jacket

| CA | $478.00 |

Terms of Sale: None

Total number of packages: 1

Reason for export: Personal Effects

Contact Name: James Smith

| Total Invoice Amount: $678.00

Total Weight: 10.0 lbs

|

| Declaration Statement: I hereby certify that information provided

is true and complete to the best of my knowledge |

Most food, chocolate and candy products can be imported to the UK at a

reduced or zero rate duty. Regardless of who you are, when shipping

food to the UK you must make sure to follow the important regulations

shown below:

- Food must have a shelf life of six months or longer

- Food must be in the original manufacturer's packaging or wrapping

- Food labels must list all ingredients including the expiry date

- Packaging should be sealed and not show any signs of tampering

The Personal Import Rules Database

provides detailed information about what can be sent. Generally, you can

send 1-2 kg of food for personal consumption. Above that, you may be charged

duties and taxes. The same rules apply for businesses.

Only businesses can send the following items:

- Any meat or meat products

- Any milk or dairy products

- Potatoes

NOTE: Permits and licences may be required

to export these food items to the UK.

The Canadian Food Inspection Agency provides a

checklist to help businesses export food internationally.

The UK Food Standards Agency also provides useful information for

non-EU businesses exporting food to the UK. More information can be

found

here.

Food, Chocolate, and Candies Checklist

- Ensure that your food products comply with the checklist above

- Clearly indicate "Food" on the commercial invoice in the General

Description or Remarks section

- Check with your carrier that they will accept food shipments

Sources:

https://www.food.gov.uk/business-guidance/imports-exports

http://www.inspection.gc.ca/food/sfcr/exports/checklist/eng/1503510719917/1503510772632

Sample Commercial Invoice for Food, Chocolate, Candies

| Ship To | Invoice |

|---|

Jamie Abbott

Jamie Abbott

35 Southend Avenue

Blackrock, NP7 5DS, ENGLAND

Phone: 613-555-1234 | Carrier tracking number: 736534736

General Description:

Food Shipment - Assorted chocolate bars in their original manufacturer's packaging

Invoice number: 123456MGEP4916926

Customs Broker: UPS

Date: 28 May 2023 |

| QTY | Description of Goods | C/O | SubTotal |

|---|

| 1 Box | Nestle Chocolate Bars in original packaging expiring May 2021 (shelf life of 6 months or longer)

| CA | $20.00 |

Terms of Sale: None

Total number of packages: 1

Reason for export: Permanent / Sold

Contact Name: James Smith

| Total Invoice Amount: $20.00

Total Weight: 10.0 lbs

|

| Declaration Statement: I hereby certify that information provided

is true and complete to the best of my knowledge |

In the UK, a commercial sample is an item that can only be used for

demonstration purposes, with the aim of encouraging people to buy or

to place orders. The benefit of having your goods cleared as samples

is that paying duties and taxes can be avoided if the receiver has a valid EORI

number.

In order to qualify for duty-free exemption, the following conditions must be met:

- The Consignee (aka. recipient) is an established commercial entity

within the UK

- A government agency or department, or public institution or public

establishment is recognised and approved by our National Import

Relief Unit (NIRU)

- The Consignee (aka. recipient) has a valid EORI number (details below)

- The item shipped has tearing, perforation, slashing, defacing, or

has permanent marking clearing indicating the item as "commercial

sample"

- The items are declared as "Commercial Sample" on the commercial

invoice (example below)

HMRC may insist that you:

- Limit the quantities of items (for example, single shoes, single

sizes)

- Limit the number of times the items are imported in a twelve-month

period

EORI Number

It is quite a quick process and you can have a valid EORI number

within three working days of applying for one.

To ship samples to the UK tax free, the receiver (individual or

business) first needs to have an EORI number. If they don't already

have one, they can visit

https://www.gov.uk/eori for details of how to get one.

NOTE: If you already have an EU EORI number,

you must register for a UK EORI number starting Jan 1st, 2021.

Sources:

https://www.gov.uk/government/publications/notice-372-importing-commercial-samples-free-of-duty-and-vat/notice-372-importing-commercial-samples-free-of-duty-and-vat

https://www.gov.uk/eori

Sample Commercial Invoice for Commercial Sample

| Ship To | Invoice |

|---|

Blackrock Book Store

Jamie Abbott

35 Southend Avenue

Blackrock, NP7 5DS, ENGLAND

Phone: 613-555-1234 | Carrier tracking number: 736534736

General Description:

Commercial Sample - Not for Resale

Invoice number: 123456MGEP4916926

Customs Broker: UPS

Date: 28 May 2023 |

| QTY | Description of Goods | C/O | SubTotal |

|---|

| 1 Box | Commercial Sample - Advanced reading copy of Dan Brown's novel.

| CA | $20.00 |

Terms of Sale: None

Total number of packages: 1

Reason for export: Commercial Sample

Contact Name: James Smith

| Total Invoice Amount: $20.00

Total Weight: 10.0 lbs

|

| Declaration Statement: I hereby certify that information provided

is true and complete to the best of my knowledge |

Advertising material includes items which are handed out to promote

products or services. They can enter the UK duties and tax free

providing that certain conditions are met:

In order to qualify for duty and tax free exemption:

- The package must weigh less than 1kg

- The commercial invoice clearly indicates "Promotional material" or

"Advertising material" in the General Description or Remarks section

(example below)

- The shipper can only send advertising material to a single receiver.

If they are sent to multiple receivers, duties and taxes will apply.

Sample Commercial Invoice for Promotional Material

| Ship To | Invoice |

|---|

York Tradeshow

James Smith

1 Abbott St

York, Y016FA, England

Phone: 613-555-1234 | Carrier tracking number: 736534736

General Description:

Promotional Material - Not for Resale

Invoice number: 123456MGEP4916926

Customs Broker: UPS

Date: 28 May 2023 |

| QTY | Description of Goods | C/O | SubTotal |

|---|

| 1 Each | Promotional Material: Not for Resale. Product pamphlets to hand out at trade show.

| CA | $163.00 |

Terms of Sale: None

Total number of packages: 1

Reason for export: Promotional Material

Contact Name: James Smith

| Total Invoice Amount: $163.00

Total Weight: 10.0 lbs

|

| Declaration Statement: I hereby certify that information provided

is true and complete to the best of my knowledge |

Shipping goods to the UK for repairs is a simple process as long as

you follow the checklist below. It is important that the shipper and

receiver indicate the correct information on the commercial invoice in

order to avoid paying additional duties or VAT.

All you need to do is write the necessary information on the

commercial invoice according to the document checklist below.

Repair Checklist

- Commercial Invoice must clearly state under the General Description

or Remarks section the following: "REPAIR & RETURN" and include the

estimated time of return

- Include repair contract with shipment

- Serial or product number and the cost of repairs must be indicated

under the Detailed Description of Goods section

- Include the original shipping documentation or tracking number

information from when the item was first exported from the UK to you

NOTE: If you don't have the original tracking

information or documentation then your shipment may be delayed by Customs,

and taxes may be charged on the shipment.

Sample Commercial Invoice for Warranty Repair

| Ship To | Invoice |

|---|

Liverpool Repair Shop

James Smith

1 Abbott St

Liverpool, L1 1DP, England

Phone: 613-555-1234 | Carrier tracking number: 736534736

General Description:

Repair and Return - Watch being sent for repair

Invoice number: 123456MGEP4916926

Customs Broker: UPS

Date: 28 May 2023 |

| QTY | Description of Goods | C/O | SubTotal |

|---|

| 1 Each | Fossil Watch being sent for repair - Model E5, serial # 789456FG7E2 - Repair Cost $76.00

| UK | $163.00 |

Terms of Sale: None

Total number of packages: 1

Reason for export: Warranty Repair

Contact Name: James Smith

| Total Invoice Amount: $163.00

Total Weight: 10.0 lbs

|

| Declaration Statement: I hereby certify that information provided

is true and complete to the best of my knowledge |

If goods are to be temporarily imported for use in the UK, there are

ways to avoid having to pay import duties or VAT, provided the goods

will remain in the same condition as they were imported. Anything that

isn't prohibited can be temporarily imported into the UK. Temporary

imports must be re-exported within two years.

In order to import your goods duty and tax free into England, you can

pick from 1 of the 3 Temporary Import Methods listed below.

Each option has its pros and cons. Regardless, each of the following

methods requires you to complete a Commercial Invoice (CI). More

details below.

| Option # | Temporary Import Method | Risk of paying Duties and taxes |

|---|

| 1 | Commercial Invoice Only (no other documentation is provided) | High - if broker cannot clear goods temporarily |

| 2 | Commercial Invoice + Temporary Admission (TA) | Very Low |

| 3 | Commercial Invoice + ATA Carnet | Very Low |

1. Complete a Commercial Invoice only

This is the simplest and quickest option.

See example.

You should be aware that shipping using this method doesn't

guarantee that your items will be imported duty/tax free. Not all

brokers will clear goods as temporary imports (i.e. UPS, Fedex, DHL)

nor is it a guarantee that customs won't charge any duties and

taxes.

2. Apply for a Temporary Admission (TA)

This option is great for one-time shipments such as a trade show booth

or specialized equipment. For more information, please visit this

link.

In addition to declaring your commercial invoice as a temporary

import (see example below), you must also apply for

Temporary Admission (TA). It is more time-consuming than option 1 however, it should ensure

that your shipment does not incur any duties and taxes.

Please keep in mind that not all brokers will clear goods as

temporary imports so make sure you check with them prior to

shipping.

3. Apply for an ATA Carnet

This option is great for items that frequently travel in and out of

the country. It's also great because once you have an ATA Carnet, it

is accepted by 176 countries worldwide making the application

process a one-time thing.

In addition to declaring your commercial invoice as a temporary

import, you can get an ATA Carnet for the items that are of

temporary nature.

ATA Carnets are beyond the scope of the article. You can however

contact your local chamber of commerce and will be able to guide you

along.

In addition to 1 of the 3 items above, the following conditions must also be met in order to qualify for duty-free exemption:

- The goods must be exported within 2 years

- The goods may NOT be sold, mortgaged, hired, disposed of, loaned

or altered in any fashion without permission of the authorities

- The words "Temporary Import/Not for Resale" are stated on the

commercial invoice under General Description.

- The words "Temporary Import" and the anticipated return date are

stated on the commercial invoice under the Detail Description of

Goods (for all applicable items)

- Ensure the Customs Broker selected can clear goods of temporary

nature (FedEx, UPS, DHL, etc. typically cannot)

- include the original tracking number

and the import date if the product is

returning

Sources:

https://www.gov.uk/government/publications/import-and-export-apply-for-temporary-admission-sp5

http://www.chamber.ca/carnet/how-to-apply-for-a-carnet/

Sample Commercial Invoice for Temporary Imports

| Ship To | Invoice |

|---|

Cambridge Tradeshow

Jamie Abbott

35 Southend Avenue

Cambridge, CB1 0AW, England

Phone: 613-555-1234 | Carrier tracking number: 736534736

General Description:

Temporary Imports - Trade show booth and display equipment returning Jan 2020

Invoice number: 123456MGEP4916926

Customs Broker: UPS

Date: 28 May 2023 |

| QTY | Description of Goods | C/O | SubTotal |

|---|

| 1 box | Temporary Imports - Trade show booth and display equipment

| CA | $1032.00 |

Terms of Sale: None

Total number of packages: 1

Reason for export: Temporary Imports

Contact Name: James Smith

| Total Invoice Amount: $1032.00

Total Weight: 10.0 lbs

|

| Declaration Statement: I hereby certify that information provided

is true and complete to the best of my knowledge |

Exporting sold goods to the UK is a straightforward process. However,

we recommend you consult a licensed UK customs broker if you are

considering exporting goods on a regular basis.

NOTE: If you already have an EU EORI number,

you must register for a UK EORI number starting Jan 1st, 2021.

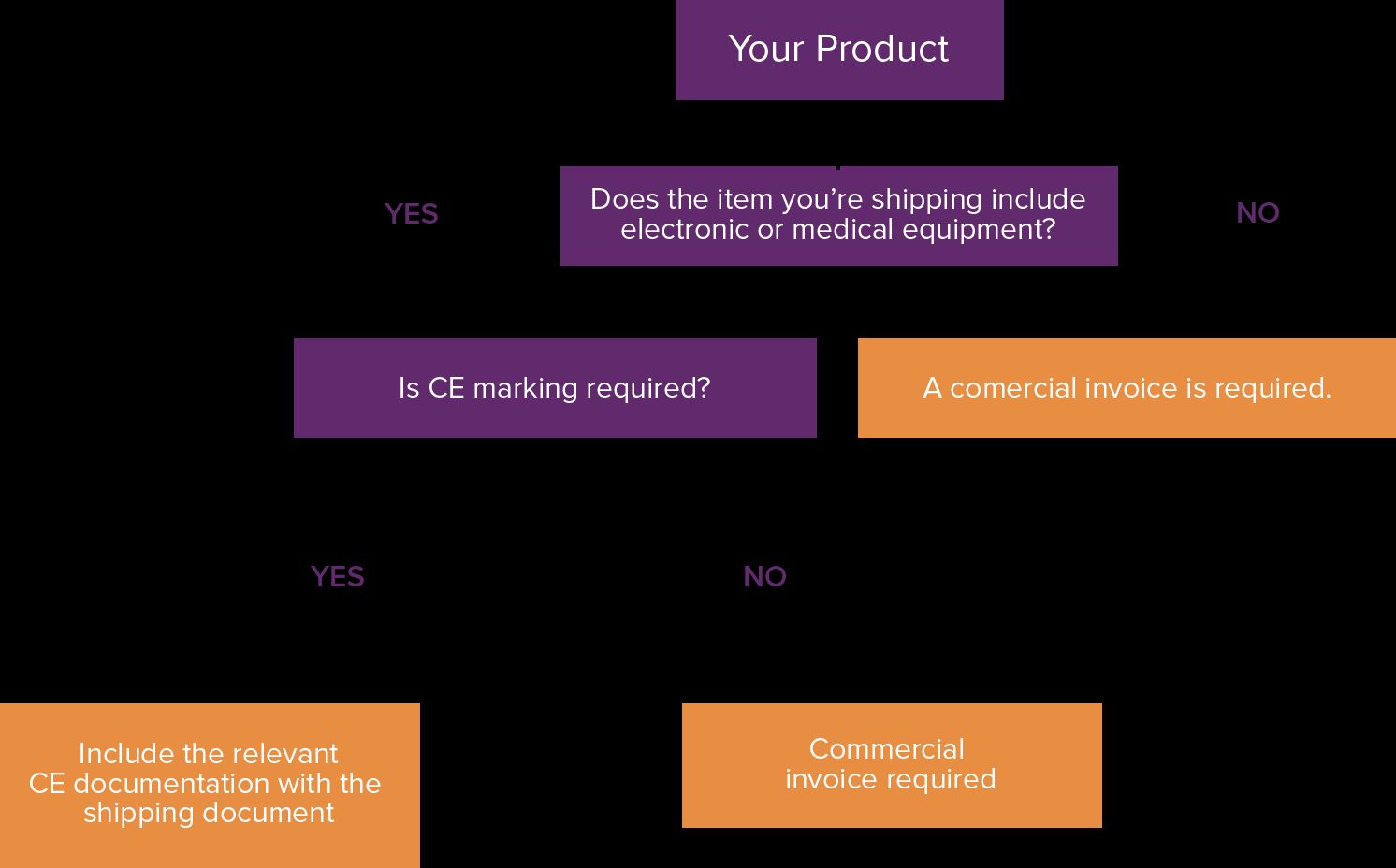

The UK government requires CE (Conformité Européene) markings on

certain products upon entry - generally for electronic equipment or

medical equipment. For the full list of products that need CE Marking

see

here.

Do I need a CE marking in addition to my commercial invoice and

other standard export documents?

Accredited UK based brokers can be found here.

Support is also available from The Canadian Trade Commissioner Service.

Sources:

https://www.gov.uk/starting-to-import

https://www.gov.uk/guidance/ce-marking

Sample Commercial Invoice for Permanent/Sold Goods

| Ship To | Invoice |

|---|

Lachlan Macquarie

35 Auburn St.

Bristol, BS1 1DL

England

Phone: 613-555-1234 | Carrier tracking number: 736534736

General Description:

Permanent/Sold: Parts and accessories for Canon B78n camera

Invoice number: 123456MGEP4916926

Customs Broker: UPS

Date: 28 May 2023 |

| QTY | Description of Goods | C/O | SubTotal |

|---|

| 15 Each | Camera Lenses: Canon EF 50mm, Canon EF 85mm & wide-angle lenses.

| CA | $132.00 |

Terms of Sale: None

Total number of packages: 1

Reason for export: Permanent/Sold

Contact Name: James Smith

| Total Invoice Amount: $1980.00

Total Weight: 10.0 lbs

|

| Declaration Statement: I hereby certify that information provided

is true and complete to the best of my knowledge |

Import duty and taxes are calculated based on the sum of the Customs

Value, Insurance Amount, and Freight costs (shipping costs). This is

known as CIF. In the UK, an additional 20% VAT is added to the CIF.

Tax (VAT) is payable on all shipments and duty is payable on shipments

with a value of £135 or more. However, certain goods attract other

taxes which will be payable before the package can be delivered.

The UK provides detailed guidance on how to value imports for customs

duty

here.

Thresholds

Some countries provide a Duty & Tax Threshold (i.e. de minimis) which

means that below a certain amount, no Duties or no Taxes are charged

on the import of that shipment.

| Currency | Pound Sterling (£/GBP) |

| TAX (VAT / GST) | 20% |

Duty Exemption

(De minimis Value) | £135 * |

Tax Exemption

(De minimis Value) | £0 |

| Threshold Method | CIF |

| Tax & Duty Calc Method | CIF |

Duties on Imports

- Mobiles 0%

- Tablets 7.2%

- Computers & Laptops 0%

- Cameras 0-15%

- Beauty Products & Cosmetics 3.7%

- Shirts & Pants 12%

- Coats 12%

- Watches 11-23%

- Jewellery 0-4%

- Home Appliances 0-3%

- Toys 0%

- Sports Equipment1-15%

- Documents 0%

- Spirits and Wines 50%

- Accessories for Electronics 0-2.7%

- Video Games & Consoles 0%

- Books 0%

- Chocolate 8-10%

- Candy 9%

- Tobacco 50%

NOTE:

The numbers above are based on the item's Country of Origin (manufacture)

being a part of the Most-Favored Nation (MFN). If the Country of Origin

is a member of the World Trade Organization (WTO), then it is part of the

MFN and hence gets the above Duty rates. Please also note that there is

an additional 20% VAT payable on the aggregate total on all imports.

Please keep in mind that we do make an effort to keep the numbers

above updated but if exact numbers are needed, please contact a

customs broker at the destination company.

Sources:

https://www.gov.uk/guidance/how-to-value-your-imports-for-customs-duty-and-trade-statistics

https://customsdutyfree.com/

https://www.simplyduty.com/calculate-uk-import-duty-taxes/

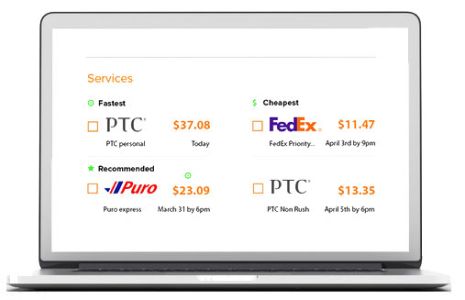

What does it cost to ship to England?

The costs to ship to the UK will vary based on the weight, size, and

destination city within England. Obtain

real-time price comparisons for parcels to the UK

by visiting our shipping calculator

here.

Does USPS ship to the UK?

Yes they do. Unfortunately, USPS is not currently available through

Secureship at this time. For more information on rates and delivery

times with USPS, please visit

https://postcalc.usps.com/

Does UPS ship to the UK?

Yes they do. You can send your packages with UPS through Secureship and

save up to 50% off the list UPS price.

Get an Instant Shipping Quote to England here.

What is the cheapest way to ship internationally to Great Britain from

Canada?

The cheapest way to ship to Great Britain is to use a multi-carrier rate

shopping platform like Secureship. Not only will you see a comparison of

prices for all the major carriers, by shipping through

Secureship, you'll save up to 50% off the list price of the carrier because of

their group buying power.

Find the cheapest way to ship to Great Britain here.

What is the best way to ship to the UK?

Shipping internationally can be complex so the best way to ship to the

United Kingdom is to use a platform like

Secureship that is designed to help shipper's of all levels. The Secureship platform

will guide you through best practices around shipping to various countries,

including England. It will also help you find the best way to ship there

in order to ensure a safe and efficient delivery of your boxes.

How long does it take to ship from Canada to the UK?

Delivery times will vary by carrier and service level chosen. You can

normally have your package picked up and delivered as early as 2

business days through a courier network. Other slower but more

economical services such as the

post office

can take as long as 1-2 months to deliver.

See delivery times for shipments from Canada to England here.