Not all types of shipments are created equal. Shipping a television will

require different paperwork, duties, and taxes than shipping an accounting

statement, for example.

Here is a list of the most common types of shipments:

You can also skip ahead to the table containing the list of

Commonly Required Documents.

Document shipments are considered non-dutiable and do not require

export documentation (i.e. they don’t require a commercial invoice or any other

export documents).

Items considered documents only for China:

- Paper documentation

- Contracts

- Blueprints

- Tickets

- Account Statements

- Invoices

- Training Material

- and more..

Not-Eligible:

- Books

- CDs

- DVDs

- and more..

Gifts that are valued less than 1,000 CNY (approximately 200 Canadian

Dollars) are exempt from duties and taxes, provided the following conditions are met:

- The words “Gift Shipment” and “Personal

Shipment” are included on the commercial invoice

- A detailed description and name of each item is provided

- A copy of the receiver’s passport is provided

NOTE: Shipments from businesses are not considered

to be gifts.

Sources:

http://www.dhl.com/en/express/customs_support/customs_paperwork/customs_guidelines_china.html

https://www.fedex.com/en-ca/shipping-services/international/regulatory/china-customs-information.html

Sample Commercial Invoice for Gifts

| Ship To | Invoice |

|---|

Smith Family in Hong Kong

James Smith

1 Jin Cheng Fang Street

E Financial Street

Hong Kong, 518003, China

Phone: 613-555-1234 | Carrier tracking number: 736534736

General Description:

Personal Shipment / Gift Shipment

Invoice number: 123456MGEP4916926

Customs Broker: UPS

Date: 28 May 2023 |

| QTY | Description of Goods | C/O | SubTotal |

|---|

| 1 each | Gift Shipment: LEGO Star Wars Rebel UWing Fighter, 659 piece set

| CA | $79.99 |

Terms of Sale: None

Total number of packages: 1

Reason for export: Gifts

Contact Name: James Smith

| Total Invoice Amount: $79.99

Total Weight: 10.0 lbs

|

| Declaration Statement: I hereby certify that information provided

is true and complete to the best of my knowledge |

Personal effects refer to separately shipped passenger's luggage,

gifts exchanged between relatives and friends. They must be declared

as personal effects, be of a reasonable quantity, and must be for

personal use.

Shipments from Hong Kong, Macao, must show the declared value less

than 800 CNY (about 160 CAD) and the assessed duty and tax value must

be less than 400 CNY (about 80 CAD.

When shipping personal effects from Canada, the declared value must be

less than 1,000 CNY (about 200 CAD) and the assessed duty and tax

value must be less than 500 CNY (about 100 CAD).

Personal effects are declared through the simplified clearance process

and a packaging list along with a commercial invoice is required. The

commercial invoice must include each item listed along with their

value and the words “Personal Effects” in the goods

description section.

In order to qualify for duty-free exemption, the following conditions must be met:

- The words “Personal Effects” are stated on the

commercial invoice under General Description and Detail Description

of Goods

- Be of reasonable quantity and for personal use

- The declared value must be less than 1,000 CNY (if over, you'll pay

duties on it)

- Passport with valid visa and entry/exit stamp by immigration

- A Packing List is also included

Source:

http://english.customs.gov.cn/Statics/4d9ec32c-efea-4a5f-9b33-e18f337c0cc5.html

Sample Commercial Invoice for Personal Effects

| Ship To | Invoice |

|---|

Shanghai Community Centre

James Smith

1 Jin Cheng Fang Street

E Financial Street

Shanghai, 200081, China

Phone: 613-555-1234 | Carrier tracking number: 736534736

General Description:

Personal effects being delivered to my new address

Invoice number: 123456MGEP4916926

Customs Broker: UPS

Date: 28 May 2023 |

| QTY | Description of Goods | C/O | SubTotal |

|---|

| 5 Pairs | Personal Effects: 5 pairs of various types of shoes

| IN | $40.00 |

Terms of Sale: None

Total number of packages: 1

Reason for export: Personal Effects

Contact Name: James Smith

| Total Invoice Amount: $200.00

Total Weight: 10.0 lbs

|

| Declaration Statement: I hereby certify that information provided

is true and complete to the best of my knowledge |

Samples are goods imported to facilitate the placing of an order. If

the value of the shipment is equal to or less than 5,000 CNY and the

total duty and tax amount does not exceed 50 CNY, the shipment will

not require duties and taxes.

Non-dutiable sample shipments must be clearly described and noted as a

“sample” on the commercial invoice. Customs will perform a

physical inspection of any shipment containing samples that are sent

with no declared commercial value.

Dutiable regardless of their value:

- Motor vehicles

- Bicycles

- Watches

- Televisions

- Recorders

- Radios

- Electric gramophones

- Cameras

- Refrigerators

- Sewing machines

- Photocopiers

- Air conditioners

- Electric fans

- Vacuum cleaners

- Acoustic equipment

- Video recording equipment

- Video cameras

- Amplifiers

- Projectors

- Calculators

- Electronic microscopes

- Electronic color analyzers and their major part

In order to qualify for duty-free exemption, the following conditions must be met:

- The word “Sample” is stated on the commercial invoice

under General Description and Detail Description of Goods

- Is not a dutiable item

- The declared value must be less than 5,000 CNY

Source:

http://english.customs.gov.cn/Statics/d30338b4-2f6a-47ea-a008-cff20ec0a6d2.html

Sample Commercial Invoice for Commercial Sample

| Ship To | Invoice |

|---|

Beijing Books

James Smith

1 Jin Cheng Fang Street

E Financial Street

Beijing, 100003, China

Phone: 613-555-1234 | Carrier tracking number: 736534736

General Description:

Commercial Sample - Not for Resale

Invoice number: 123456MGEP4916926

Customs Broker: UPS

Date: 28 May 2023 |

| QTY | Description of Goods | C/O | SubTotal |

|---|

| 1 each | Commercial Sample - Advanced reading copy of Dan Brown's novel, Origin

HTS Code: 4901.99.00.01 | CA | $20.00 |

Terms of Sale: None

Total number of packages: 1

Reason for export: Commercial Sample

Contact Name: James Smith

| Total Invoice Amount: $20.00

Total Weight: 10.0 lbs

|

| Declaration Statement: I hereby certify that information provided

is true and complete to the best of my knowledge |

Similar to samples, all advertising material or marketing material

shipments become dutiable unless the duty value is less than 50 CNY

(about $10 CAD), or listed as having no commercial value.

NOTE: All shipments that are declared as

having no commercial value undergo a strict examination and inspection.

Sample Commercial Invoice for Promotional Material

| Ship To | Invoice |

|---|

Shenzhen Trade Show

James Smith

1 Jin Cheng Fang Street

E Financial Street

Shenzhen, 518009, China

Phone: 613-555-1234 | Carrier tracking number: 736534736

General Description:

Promotional Material - Not for Resale

Invoice number: 123456MGEP4916926

Customs Broker: UPS

Date: 28 May 2023 |

| QTY | Description of Goods | C/O | SubTotal |

|---|

| 1 Box | Promotional Material: Not for Resale. Product pamphlets to hand out at trade show.

| CA | $20.00 |

Terms of Sale: None

Total number of packages: 1

Reason for export: Promotional Material

Contact Name: James Smith

| Total Invoice Amount: $20.00

Total Weight: 10.0 lbs

|

| Declaration Statement: I hereby certify that information provided

is true and complete to the best of my knowledge |

When importing commodities for repair, the following is required to obtain duty-free exemption:

- Commercial Invoice (3 copies)

- Repair Contract or the original export contract that contains a

warranty clause

- Items being repaired must be re-exported within the time limit

prescribed by Chinese Customs

When these documents are provided and the importer provides the

deposit to Customs, commodities returned to China for repair will be

released duty-free.

Source:

http://english.customs.gov.cn/Statics/53a77dc4-c835-460a-b773-f5f7cef63a33.html

Sample Commercial Invoice for Warranty Repair

| Ship To | Invoice |

|---|

Guangzhou Repair Shop

James Smith

1 Jin Cheng Fang Street

E Financial Street

Shenzhen, 510045, China

Phone: 613-555-1234 | Carrier tracking number: 736534736

General Description:

Repair and Return - Watch being sent for repair

Invoice number: 123456MGEP4916926

Customs Broker: UPS

Date: 28 May 2023 |

| QTY | Description of Goods | C/O | SubTotal |

|---|

| 1 Each | Fossil Watch being sent for repair - Model E5, serial # 789456FG7E2 - Repair Cost $76.00

| CN | $163.00 |

Terms of Sale: None

Total number of packages: 1

Reason for export: Warranty Repair

Contact Name: James Smith

| Total Invoice Amount: $163.00

Total Weight: 10.0 lbs

|

| Declaration Statement: I hereby certify that information provided

is true and complete to the best of my knowledge |

If goods are to be temporarily imported for use in China, there are

ways to avoid having to pay import duties or taxes, provided certain

conditions are met.

There are 2 ways to do a temporary import into China. Each method has

pros and cons. Regardless, each of the following methods requires you

to complete a commercial invoice.

1. Complete a Commercial Invoice only

This is the simplest and quickest option.

See example.

You should be aware that shipping using this method doesn't

guarantee that your items will be imported duty/tax free. Not all

brokers will clear goods as temporary imports (i.e. UPS, Fedex, DHL)

nor is it a guarantee that customs won't charge any duties and

taxes.

2. Apply for an ATA Carnet

This option is great for items that frequently travel in and out of the

country. It's also great because once you have an ATA Carnet, it is accepted

by 176 countries worldwide making the application process a one-time

thing.

In addition to declaring your commercial invoice as a temporary

import, you can get an ATA Carnet for the items that are of

temporary nature.

ATA Carnets are beyond the scope of the article however, you can

find more information here: http://www.chamber.ca/carnet/

The types of approved temporary imports include:

- Goods displayed or used in exhibitions, fairs, meetings or similar

activities

- Articles for performance or contests used in cultural or sports

exchanges

- Devices, equipment or articles used in news reporting, or the

shooting of films or television programmes

- Devices, equipment or articles used in scientific, teaching, and

medical activities

- Transportation vehicles and special types of vehicles used in

activities listed in the items above

- Samples (refer to samples of goods used in exhibition, operation demo,

reference of goods supplied and ordered, and samples of goods

detected and tested, but excluding the identical goods that exceed

the reasonable quantity imported or exported by the same consignee

or consignor)

- Apparatus, equipment and articles used in charity activities

- Apparatus and tools used for the installing, debugging, testing and

repairing the equipments

- Containers for goods

- Self-driving vehicles as well as the articles thereof used for

traveling

- Equipment, apparatus and articles used in the construction of

projects

- Other goods temporarily imported or exported as approved by Customs.

In order to qualify for duty-free exemption, the following

conditions must be met:

- The words “Temporary Imported” are stated on the

commercial invoice under General Description and Detail Description

of Goods

- Item qualifies for temporary import (see list above)

- Indicate the expected date of export on the Commercial Invoice

- If the item is leaving the country, show the original tracking

number on the Commercial Invoice

- Can only remain in China for 6 months (unless extension has been

granted)

Sources:

http://english.customs.gov.cn/Statics/7fb7fc01-c3ef-4d09-9ef2-8c69e3dba127.html

http://www.customscounsel.com/en/lawyer/4facbb7c7c034dd7945117d76d50147d/30554.html

Sample Commercial Invoice for Temporary Imports

| Ship To | Invoice |

|---|

Tianjin Show

James Smith

1 Jin Cheng Fang Street

E Financial Street

Tianjin, 300103, China

Phone: 613-555-1234 | Carrier tracking number: 736534736

General Description:

Temporary Imports - Trade show booth and display equipment returning Jan 2020

Invoice number: 123456MGEP4916926

Customs Broker: UPS

Date: 28 May 2023 |

| QTY | Description of Goods | C/O | SubTotal |

|---|

| 1 box | Temporary Imports - Trade show booth and display equipment

| CA | $1032.00 |

Terms of Sale: None

Total number of packages: 1

Reason for export: Temporary Imports

Contact Name: James Smith

| Total Invoice Amount: $1032.00

Total Weight: 10.0 lbs

|

| Declaration Statement: I hereby certify that information provided

is true and complete to the best of my knowledge |

Importing and selling goods in China can be very lucrative for

businesses, however, it’s important to understand the

regulations before getting started to avoid any unnecessary headaches

or potential legal troubles.

Before importing into China it’s important to check if you

product will require a China Compulsory Certification (CCC) mark.

Commodities listed in the official commodity catalog cannot leave the

manufacturing facility, be imported into China, or be used in any

business operational activities inside of China without obtaining the

CCC mark.

The Chinese government agency, Certification and Accreditation

Administration (CNCA), will administer the CCC mark certification

process. The China Quality Certification Center (CQC) has been

designated by the CNCA to process the CCC mark applications. Chinese

Customs may hold products not meeting the CCC requirements and impose

penalties on the importers or consignees.

The following is an abbreviated listing of the commodities requiring

certification:

- Appliances for home or similar usage

- Audio/video devices

- Circuit switches and electric devices used for protection

- Electric tools

- Electric welding machines

- Electric wires and cables

- Information technology devices

- Lighting devices (for example, electrical lamps, electrical lights)

- Low power electric motors

- Low voltage electric apparatuses

- Motor vehicle and safety accessories

- Motor vehicle tires

- Safety glass

- Telecommunication terminal devices

Additionally, spare parts and replacement parts may, in some cases,

require CCC certification or may qualify for an exemption (requires an

application form).

The full list of affected commodities and the CCC online application

guide are available from the CQC Web site at http://www.ccc-cn.org/ccccatalog.htm.

In addition to the CCC mark, goods must have the country of origin

printed or embossed on each item- “Made in Canada” for

example. The country of origin must also be included on the Commercial

Invoice.

You should also check to see if your product will require a safety

license or other special clearance documentation. For example,

medicines, foodstuffs, animal and plant products, electronics, and

mechanical products require a safety license.

Source:

http://www.ccc-certificate.org/en/

Import duty and taxes in China are calculated based on the sum of the

Customs Value, Insurance Amount, and Freight costs (shipping costs).

This is known as CIF.

Using the CIF Value, you can predict how much Duty & Tax the recipient

would have to pay the Chinese government to receive their goods.

Thresholds

Some countries provide a Duty & Tax Threshold (i.e. de minimis) which

means that below a certain amount, no Duties or no Taxes are charged

on the import of that shipment.

| Currency | Chinese Yuan (CNY) |

| TAX (VAT / GST) | 16% |

Duty Exemption

(De minimis Value) | 0 USD |

Tax Exemption

(De minimis Value) | 0 USD |

| Threshold Method | CIF |

| Tax & Duty Calc Method | CIF |

| |

Duties on Imports

- Mobiles 0%

- Tablets 0%

- Computers & Laptops 0%

- Cameras 0-15%

- Beauty Products & Cosmetics 6.5%

- Shirts & Pants 14-16%

- Coats 16-25%

- Watches 11-23%

- Jewellery 17-35%

- Home Appliances 10-15%

- Toys 0%

- Sports Equipment10-24%

- Documents 0%

- Accessories for Electronics 0-2.7%

NOTE:

The numbers above are based on the item’s Country of Origin (manufacture)

being a part of the Most-Favored Nation (MFN). If the Country of Origin

is a member of the World Trade Organization (WTO), then it is part of the

MFN and hence gets the above Duty rates. Please keep in mind that we do

make an effort to keep the numbers above updated, but if exact numbers

are needed, please contact a customs broker at the destination company.

Sources:

http://tariffs.hktdc.com

https://www.tradecommissioner.gc.ca/china-chine/import-importation.aspx?lang=eng

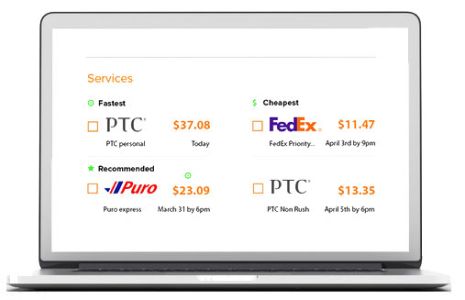

What does it cost to ship to China?

The costs to ship to China will vary based on the weight, size, and

destination city within China. Obtain

real-time price comparisons for parcels to China

by visiting our shipping calculator

here.

What is the cheapest way to ship to China from Canada?

You can find the cheapest way to ship to China by using the Secureship

platform to get a price comparisons with all the major carriers. You can

then save even more (up to 50% off the list price of the carrier) by shipping

your boxes through Secureship because of their group buying power.

Find the cheapest way to ship to China here.

Does FedEx ship to China?

Yes they do. FedEx has a few shipping options to China such as

International Priority or International Economy. To find out cost and

delivery times, simply use the Secureship

Instant FedEx Shipping Cost Calculator found here. Secureship provides preferred pricing with FedEx so you can save up

to 50% off the FedEx list price by shipping your parcels directly with

Secureship.

Does UPS ship to China?

Yes they do. You can send your boxes with UPS through Secureship and

save up to 50% off the list UPS price.

Get an Instant Rate Quote to China here.

Does Canada Post ship to China?

Yes they do. Delivery times will vary depending on the service level you

choose. Priority Worldwide (provided by FedEx) can have your package

delivered as early as 3 business days. Small Packet Air generally takes

6-10 business days and Small Package Surface takes 2-3 months for your

boxes to be delivered.

See delivery times with all Major carriers here.

What is the best way to ship to China?

Shipping internationally can be very difficult so it is recommended you

use a platform like

Secureship that is designed to help shipper's of all levels. The Secureship platform

will guide you through best practices around shipping to various countries,

including China, and help you find the best way to ship your packages there.

Is there express shipping to China?

The carriers on the Secureship network do provide express shipping

options to China. Pickups and deliveries can happen in as little as 3

business days.

View all express shipping options to China.

What can I send to China?

The list of items that can be shipped to China changes often so it's

always best to check the official customs page here. A summary

of what is prohibited and restricted can be found above.

How long does it take to ship from Canada to China?

Delivery times will vary by company and delivery option chosen. You can

have your parcels delivered as early as 3 business days with 5-8

business days as the standard delivery time-frame. There are slower and

more economical services such as the

post office

but they can take as long as 2-3 months to deliver your items.

See delivery times for shipments from Canada to China here.